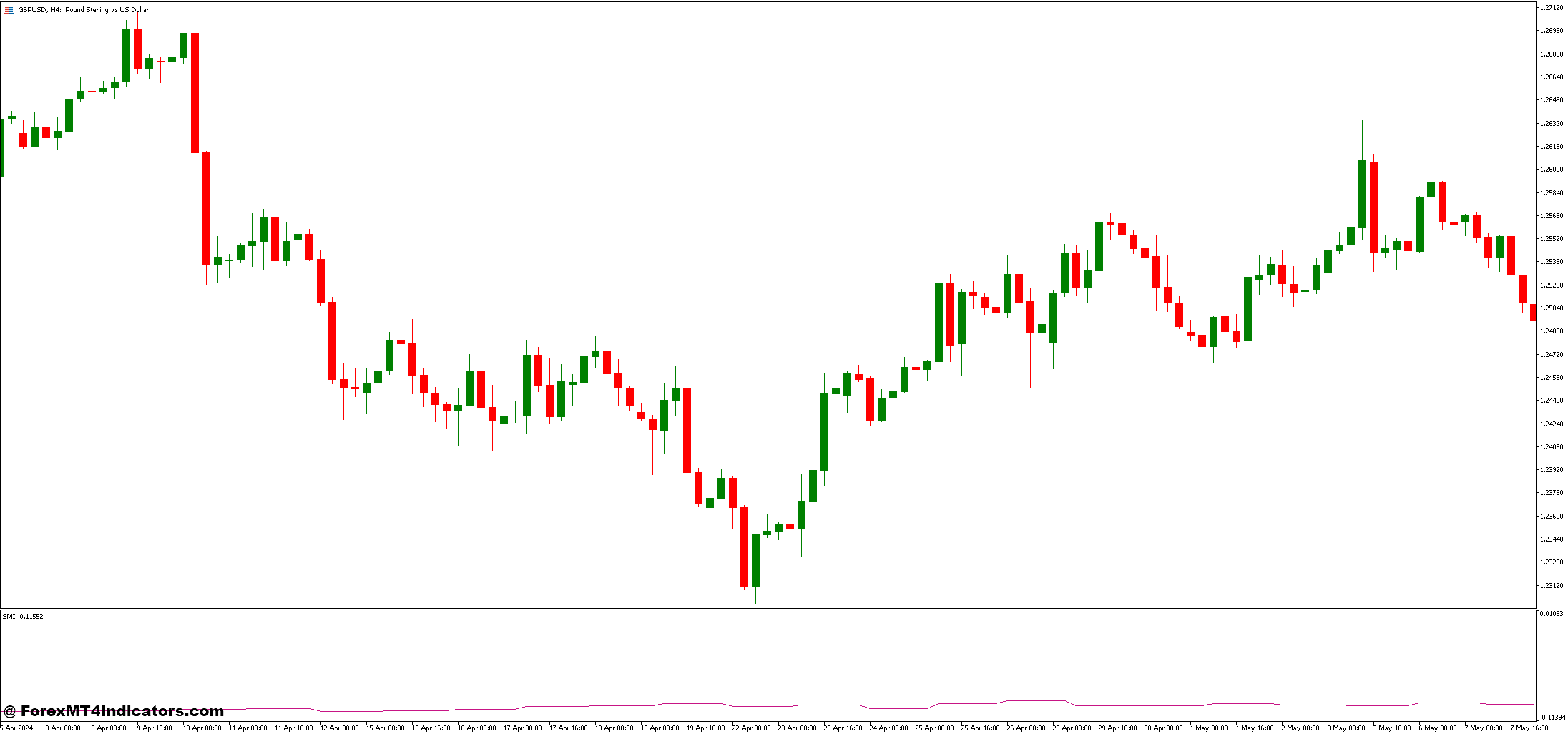

Repulse SMI Indicator

The Repulse SMI Indicator is a variation of the traditional Smoothed Momentum Indicator (SMI), designed to offer a clearer and more refined view of market momentum. The primary advantage of the Repulse SMI over other momentum indicators is its ability to smooth out market noise and filter out insignificant fluctuations, allowing traders to better focus on the genuine market trends.

Key Features of the Repulse SMI Indicator

- Smoothed Data: The Repulse SMI is designed to eliminate the “noise” in market data, making it easier for traders to spot the actual trend direction. By smoothing price action, it reduces the impact of short-term volatility, giving a more reliable picture of momentum.

- Momentum Analysis: This indicator helps measure the strength and direction of the market by comparing the current price with a moving average over a specified period. Strong momentum indicates that the market is moving in a clear direction, while weak momentum suggests consolidation or indecision.

- Overbought and Oversold Conditions: Like many momentum indicators, the Repulse SMI is capable of identifying overbought and oversold conditions. A market that is in an overbought condition may soon experience a reversal, while an oversold condition could indicate the potential for a bounce or upward price movement.

- Divergence Signals: The Repulse SMI can also provide valuable divergence signals, where the price makes new highs or lows, but the indicator fails to confirm the move. This can be a warning sign of a potential reversal or a weakening trend.

Breakout Indicator

The Breakout Indicator is a trading tool used to identify potential breakout points in the market. A breakout occurs when the price moves beyond a significant support or resistance level, often accompanied by an increase in volume or volatility. Breakout strategies aim to capture large price movements that follow these breakouts, which typically mark the beginning of a new trend.

Key Features of the Breakout Indicator

- Support and Resistance Levels: The core principle of breakout trading revolves around identifying key support and resistance levels. These are the price levels where the market has historically reversed or consolidated. When the price breaks through these levels, it suggests that there is enough momentum to continue in the direction of the breakout.

- Volatility and Volume: Breakout indicators often rely on increased volatility and volume to confirm the validity of the breakout. A breakout accompanied by a significant surge in volume indicates that the breakout is likely to be sustained. Conversely, a breakout with low volume may suggest that the move lacks strength and could reverse quickly.

- Types of Breakouts: Breakout indicators can be applied to various market conditions. Common types of breakouts include:

- Price Breakouts: When the price moves above resistance or below support.

- Chart Pattern Breakouts: These occur when the price breaks out from chart patterns like triangles, flags, or channels, signaling a continuation or reversal of the trend.

- Range Breakouts: Breakouts from tight trading ranges where the price has been consolidating, signaling a potential shift in momentum.

- False Breakouts: One challenge of breakout trading is the occurrence of false breakouts, where the price breaks a key level only to reverse shortly afterward. Breakout indicators often include confirmation features such as volume spikes or momentum indicators to reduce the risk of false breakouts.

How to Trade with Repulse SMI and Breakout Forex Trading Strategy

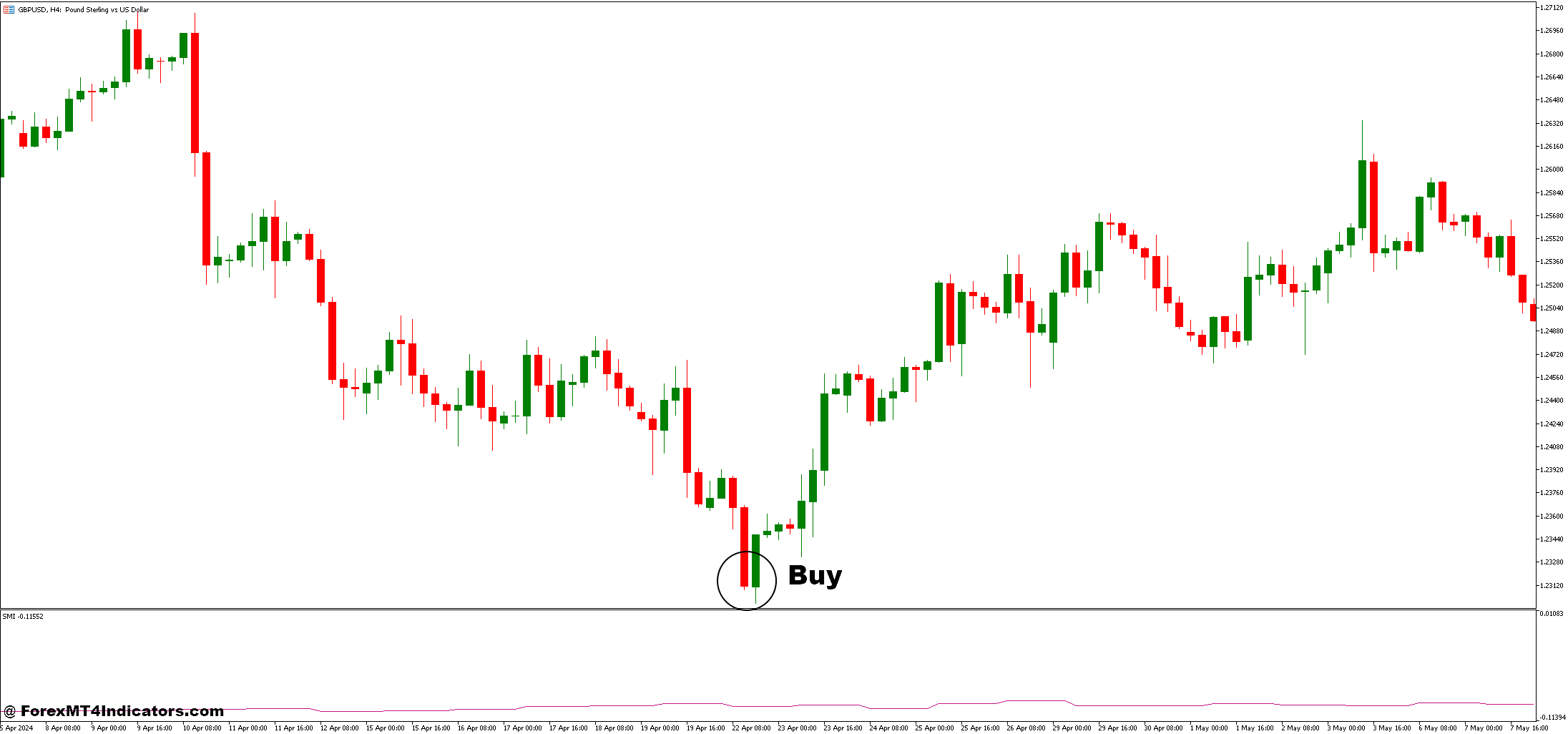

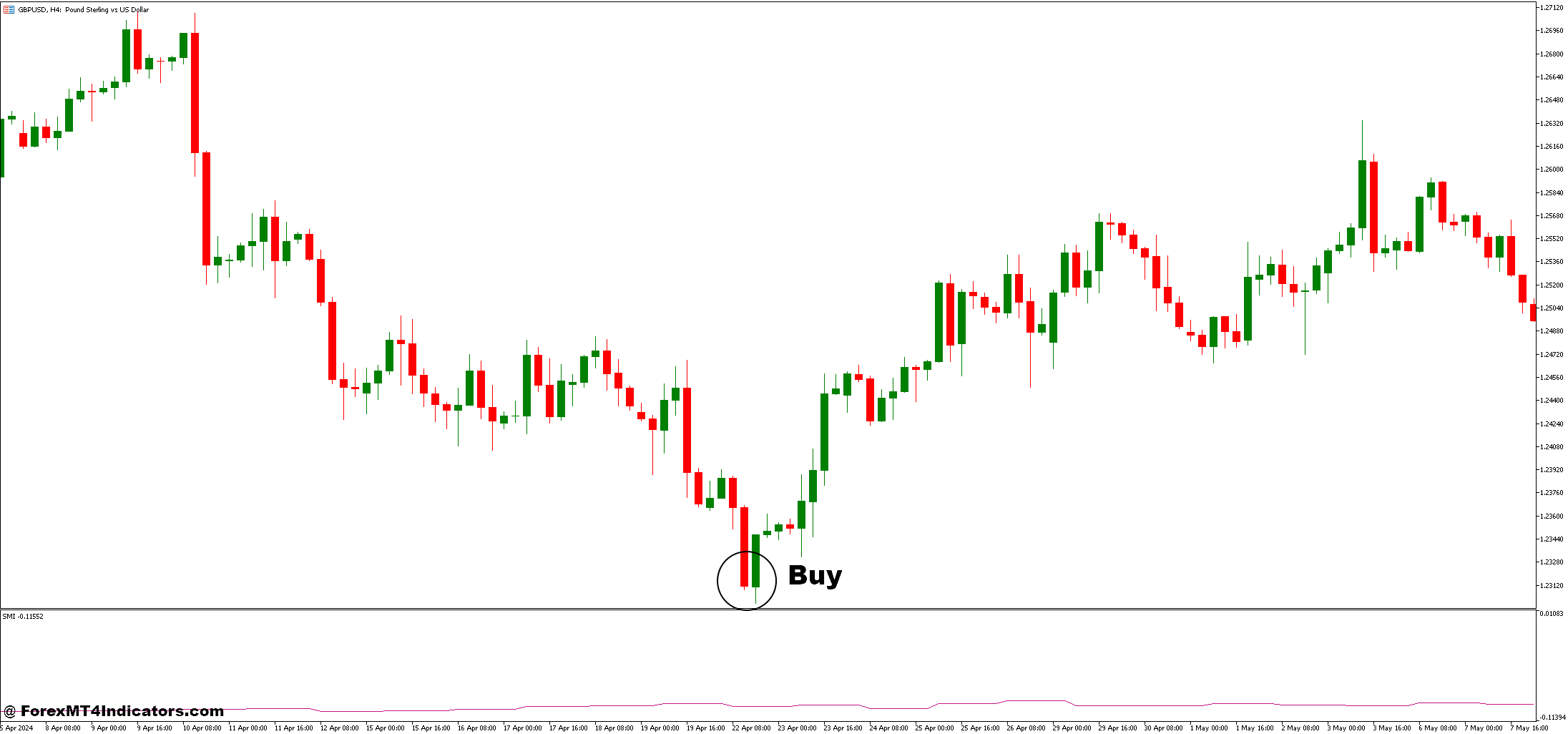

Buy Entry

- Identify Key Resistance Level: Locate a significant resistance level on the chart.

- Wait for Breakout: Monitor the price action as it breaks above the identified resistance level.

- Confirm with Repulse SMI: Ensure the Repulse SMI is above the zero line, confirming strong bullish momentum.

- Enter the Trade: Enter a buy position once the price has broken above resistance and the Repulse SMI confirms positive momentum.

- Set Stop Loss: Place a stop-loss just below the breakout level or below the previous swing low.

- Set Take Profit: Place a take-profit level based on the next key resistance or using a favorable reward-to-risk ratio.

- Monitor Momentum: Continuously monitor the Repulse SMI for any signs of momentum weakening. If the Repulse SMI begins to weaken or cross back into neutral, consider exiting the position.

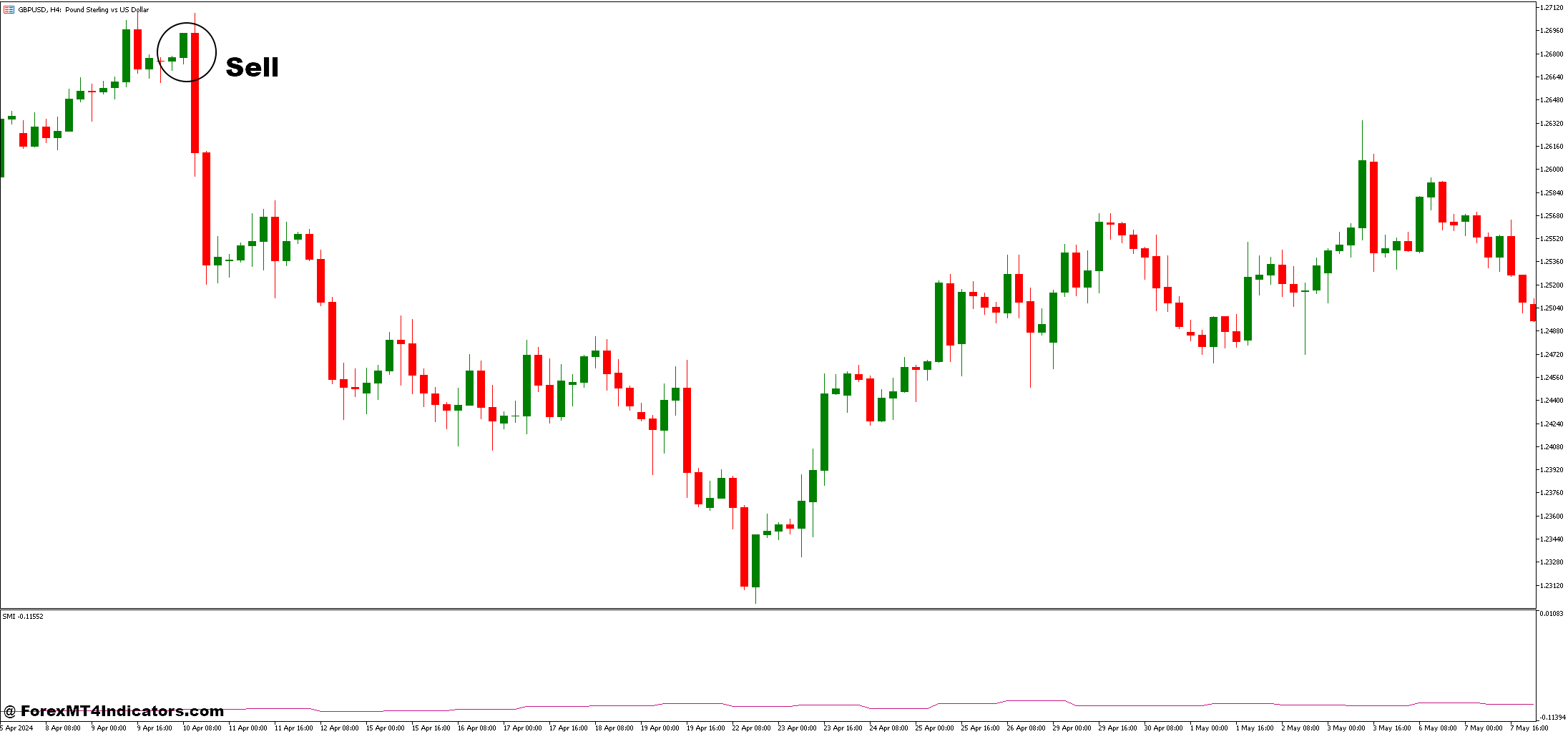

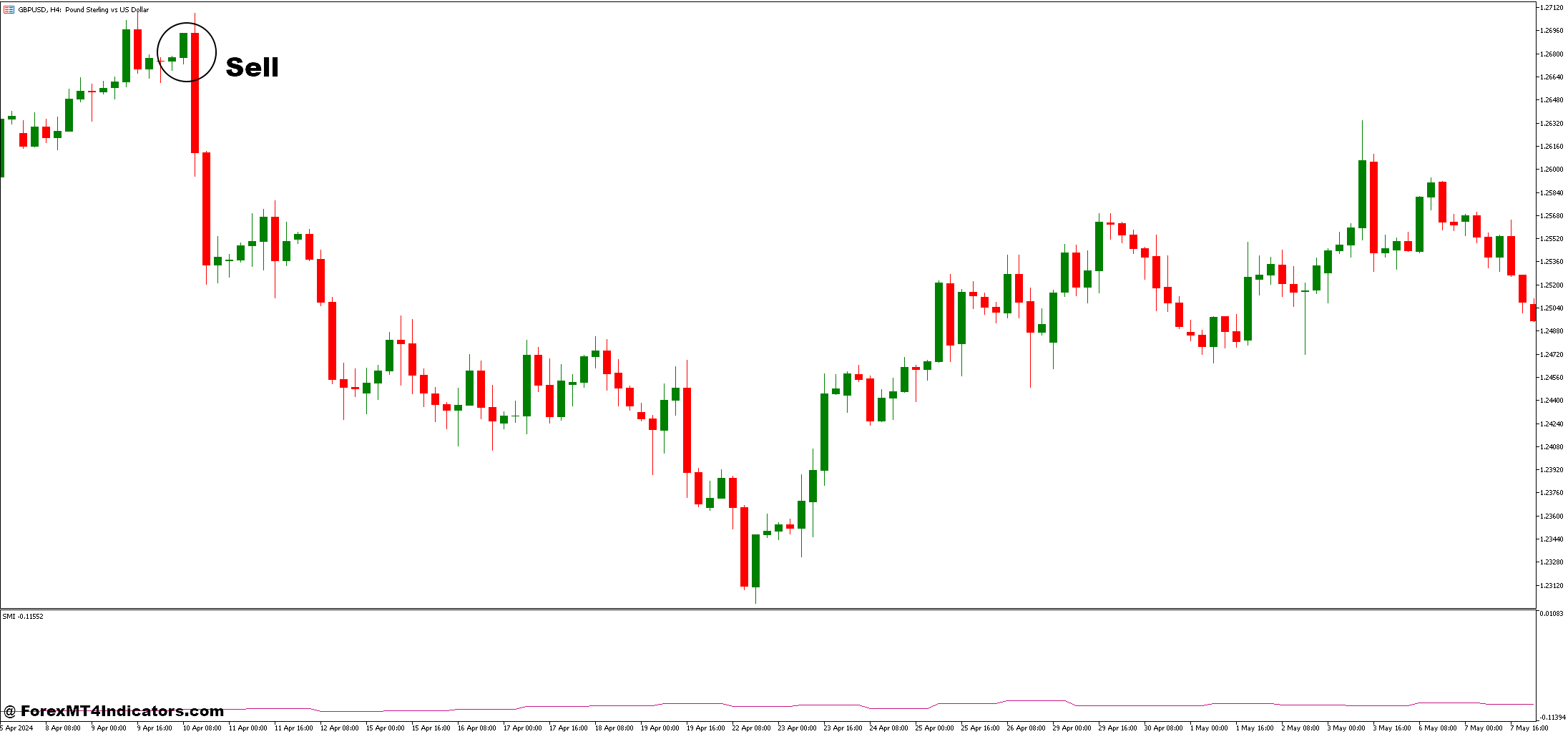

Sell Entry

- Identify Key Support Level: Locate a significant support level on the chart.

- Wait for Breakout: Watch for the price to break below the identified support level.

- Confirm with Repulse SMI: Ensure the Repulse SMI is below the zero line, indicating bearish momentum.

- Enter the Trade: Enter a sell position once the price has broken below support and the Repulse SMI confirms negative momentum.

- Set Stop Loss: Place a stop-loss just above the breakout level or above the previous swing high.

- Set Take Profit: Place a take-profit level based on the next key support or using a favorable reward-to-risk ratio.

- Monitor Momentum: Keep an eye on the Repulse SMI. If it starts to show signs of weakening or moves into neutral territory, consider closing the trade early.

Conclusion

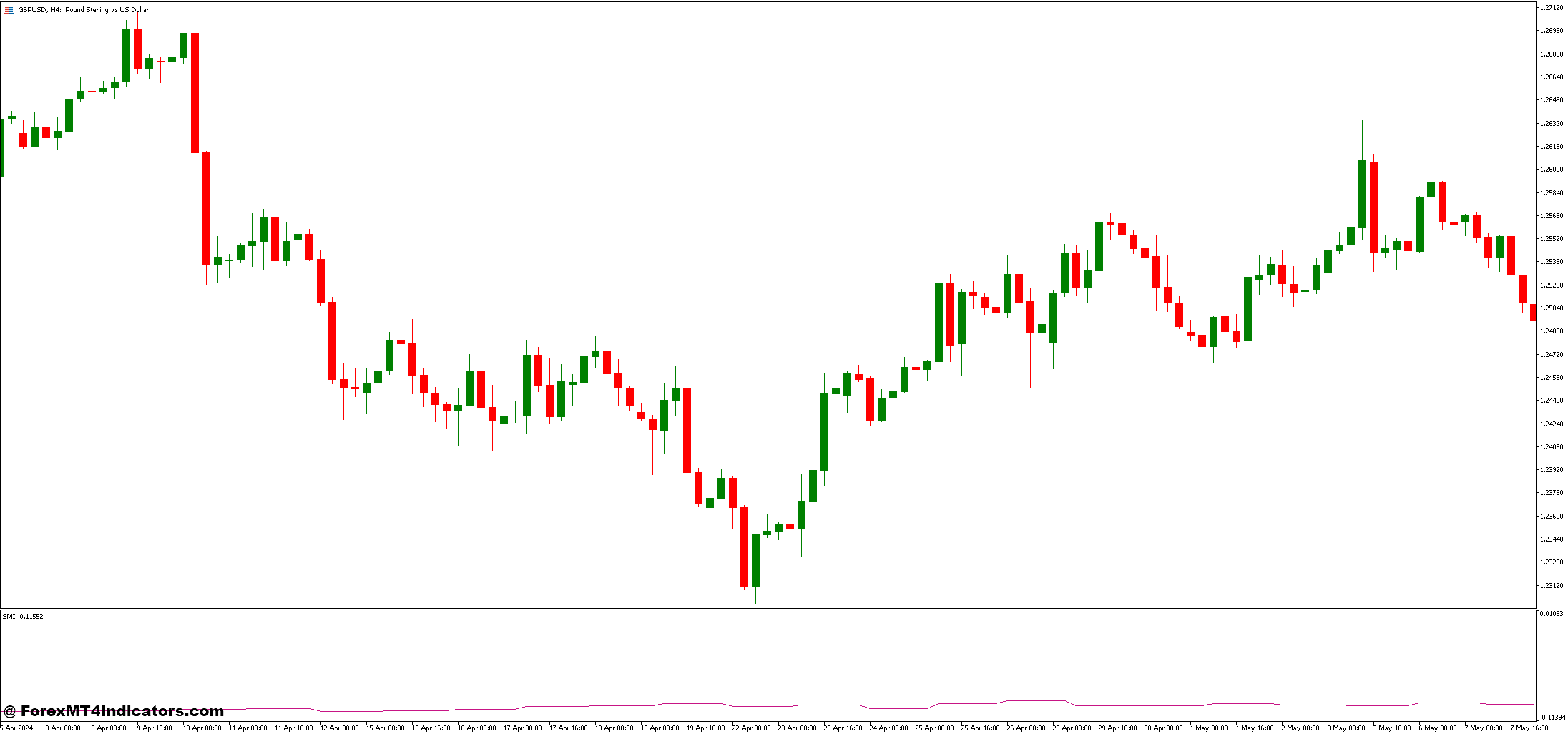

The Repulse SMI and Breakout Forex Trading Strategy is a highly effective approach for traders looking to capture profitable trends with solid confirmation. By combining the power of breakout strategies, which identify key support and resistance levels, with the momentum confirmation provided by the Repulse SMI, this strategy enhances your ability to enter trades with high probability and strong directional movement.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Save

Save

Get Download Access